|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

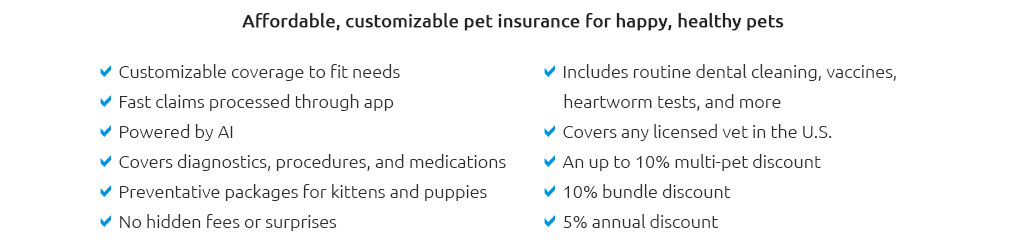

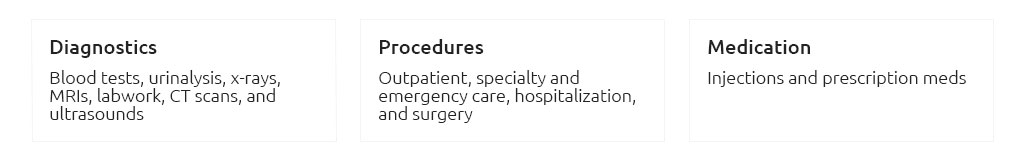

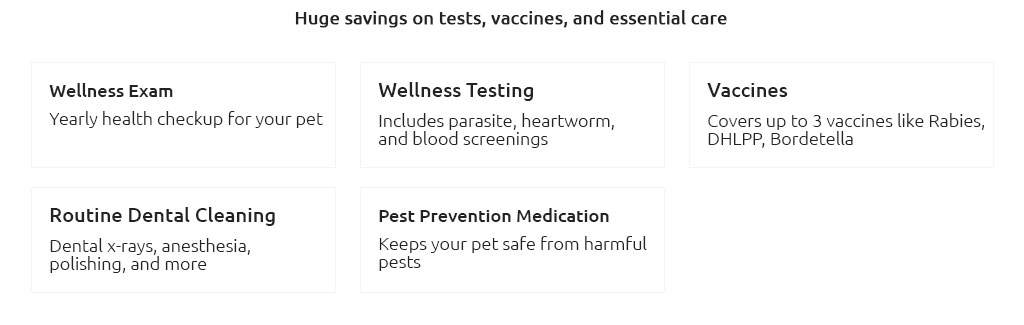

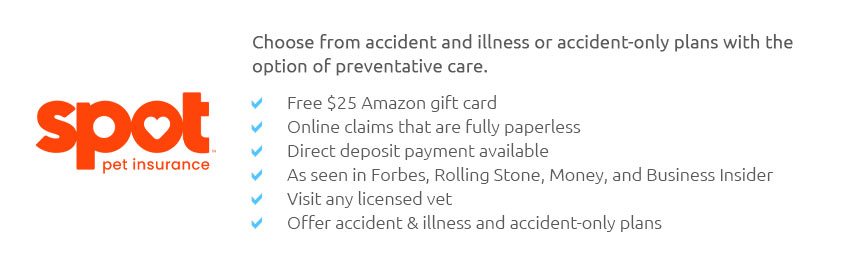

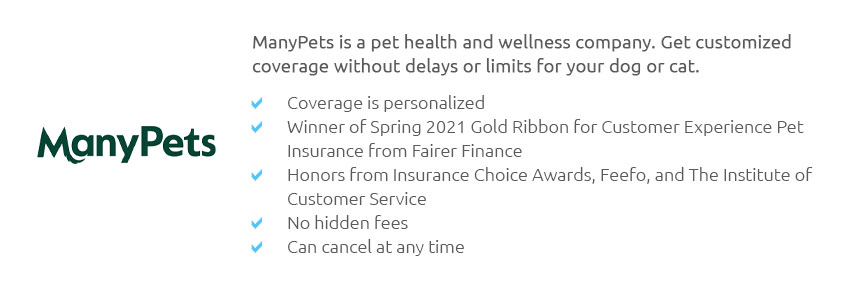

Understanding Insurance for Your Canine CompanionIn the ever-evolving landscape of pet ownership, insurance for dogs has emerged as a topic of considerable importance. As more households embrace their furry friends as integral members of the family, ensuring their health and well-being has become a priority. But what exactly does dog insurance entail, and why should you consider it? Dog insurance operates similarly to health insurance for humans. Essentially, it is a policy purchased to mitigate the potential financial burden associated with unexpected veterinary expenses. These policies typically cover a range of scenarios, from accidents and illnesses to routine care, depending on the level of coverage chosen. One might argue that the peace of mind it offers is invaluable. Pet owners can select from various insurance plans, each tailored to different needs and budgets. A comprehensive plan, for instance, might include coverage for surgeries, prescription medications, and even dental care. On the other hand, basic plans generally cover accidents and emergency treatments, which can still save owners a substantial amount when the unexpected occurs. While the concept of insuring a pet may initially seem excessive, consider this: veterinary bills can be unexpectedly high. A routine visit for minor ailments can quickly escalate into a financial strain if advanced diagnostics or treatments are required. Insurance for dogs can alleviate these financial pressures, allowing pet owners to focus on their pet's recovery rather than the cost involved. However, it is important to weigh the benefits against the costs. Premiums can vary significantly based on factors such as the dog's age, breed, and health history. Certain breeds prone to genetic conditions might attract higher premiums, which some pet owners may find prohibitive. Nonetheless, for many, the potential savings in veterinary expenses justify the initial outlay.

In conclusion, dog insurance provides a safety net that can significantly ease the financial burden of unexpected veterinary care. While it's not mandatory, it is a worthwhile consideration for any responsible pet owner. With a myriad of options available, it's possible to find a policy that aligns with your financial situation and provides comprehensive coverage for your beloved pet. Ultimately, the decision to insure your dog is a personal one, but it's undeniably a step towards responsible pet ownership, offering both protection and peace of mind. https://www.petinsurance.com/

The best pet insurance ever by Nationwide. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. https://www.aspcapetinsurance.com/dog-insurance/

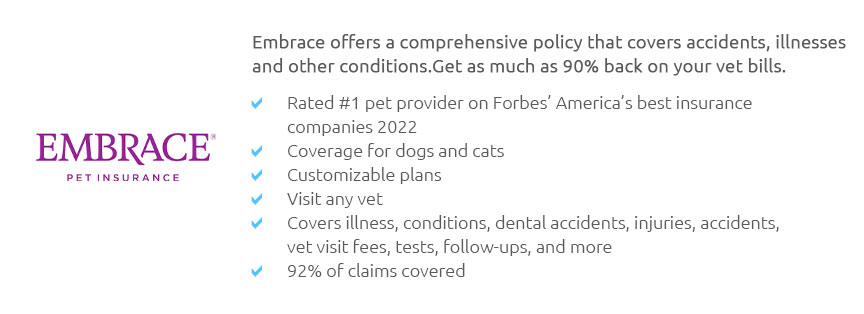

Complete Coverage SM for Dogs starting as low as $10/month. Complete Coverage SM plans cover Diagnostics Think X-rays, MRI, blood tests, urinalysis, ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ...

|